Media is hugely important to the UK’s economy and – despite a tough couple of years – it is continuing to grow. The UK is set to become the largest entertainment market in Europe, with some predicting that it will be worth almost £100 billion by 2026.

As with any other industry, there have been huge changes in media over the past couple of decades, and there are many still afoot. In today’s blog, the media experts at Trigg have taken a closer look at some of the key trends affecting the media industry right now, as well as those coming up in the next 12 months.

- The Digital Revolution

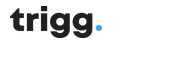

The move to digital is expected to continue to dominate the media industry, as it has done for the past few years. In fact, earlier this year, the UK Interactive Advertising Bureau (UK IAB) reported that digital advertising in the UK was worth £23 billion in 2021 – 74% of the total UK advertising market. There’s no sign of it stopping either, with digital ad spending expected to reach over £34 billion by 2026.

It isn’t a surprise that digital has taken such a large portion of the media pie – after all, every media owner is also an owner of digital content in some form. But many businesses, especially news media companies, have taken it that extra step further by making the move to online-only media. Take Time Out, for example, a previously print publication, now only publishes online. Meanwhile, The Guardian (one of the UK’s biggest publishers) earns more revenue from digital than anything else – the Guardian Media Group revealed earlier this year that two-thirds of its total income now comes from its online operations.

The truth is, most media owners are moving to digital. We can hardly blame them – after all, it’s often more profitable.

- Consolidation

Another trend we can expect to see more of in 2023 is consolidation, as the industry’s major players merge or acquire other smaller firms. This trend has already started to reshape the industry, and it doesn’t show any sign of slowing down.

So far, we’ve seen media owners such as National World (which was set up by the newspaper entrepreneur and former Mirror Group CEO David Montgomery) bringing together newspaper groups and buying up local newspapers from across the UK to form one huge news source. Meanwhile, Bauer Media has continued to bolster its multimedia portfolio by purchasing smaller radio groups, including Lincs FM Group, UKRD and Celador Radio, bringing them together under one banner and a single sales point.

Consolidation does not come without its challenges, not least with a larger product catalogue to deal with, but it also brings with it enormous benefits, particularly when it comes to economies of scale. Plus, with multiple brands all under one roof, each business has the potential to reach shiny new audiences, all whilst pumping more money back into the parent organisation to continue improving content and services. With this in mind, consumers can expect to be exposed to new media brands in the near future, and to be served better, more relevant content.

- Multimedia

Another key trend currently gaining pace in the industry is the tendency for media businesses to diversify rather than specialise in one form of media. By choosing to diversify, media companies can generate new streams of revenue, making for a far more sustainable business model.

After all, consumers don’t just stick to one type of media – most people consume various types of media each day, whether they’re watching TV, listening to the radio, catching up on podcasts, or just looking at billboards while on their commute. By spreading their content and investment over various media outlets, media owners can easily expand their overall reach and improve their potential advertising revenue.

So, what does diversification look like IRL? Well, it looks a lot like News UK, a media company originally focused on print newspapers. Over the past few years, the organisation made the pivotal decision to break free of its print roots and deal additionally in digital and radio content – adding household names such as Virgin Radio, Talksport and Times Radio to its repertoire in recent years.

- Subscription Models

As they shift to digital and expand their multimedia horizons, many organisations in the media industry have transitioned from charging for print copies to charging for a digital media subscription with freemium models becoming the norm. Subscription models of all types have seen a boom in recent years, but their potential to help media companies to rake in more revenue through gated content and on-demand services has been particularly prevalent. The global subscription market size has already grown enormously in the past year and is expected to continue growing up to as much as $1.5 trillion by 2025. As more people want to be able to access content digitally and on-demand, there lies an opportunity for online distributors of all types to charge for their content.

- New Approaches To Media Advertising

New innovations are allowing media companies to take an entirely new approach to advertising, whilst also helping businesses of all sizes to reach their target audiences (even those with smaller ad budgets). For example, Sky AdSmart, which launched back in 2014, has changed the way that businesses can advertise themselves on television. By allowing marketers to choose their target audience based on demographic information and exact location, this revolutionary ads service made TV ads accessible to brands and companies that would only have dreamed of purchasing this kind of ad space in the past. And that was just the beginning.

Today (3rd November 2022) brings probably the biggest media advertising story since the launch of AdSmart, as on-demand video giant Netflix begins to sell advertising space. With a new pricing tier, Netflix customers can save money on their monthly subscription but, in return, they have to watch adverts during their favourite shows and movies of up to initially 4-5 minutes duration per hour. The company is expecting to generate 500,000 new subscribers for this new tier, opening up a whole new audience for video advertisers whilst creating a new and lucrative revenue stream for Netflix.

- Embracing New Technologies

Above all, the most successful media organisations of the past decade have had one thing in common: the ability to embrace new technologies. As the technology available to the industry has rapidly evolved, businesses have been forced to adapt their strategies accordingly or risk falling behind.

One emerging technology that has swept the media industry recently has been the introduction of Customer Relationship Management (CRM) platforms. To tap into the digital growth today’s market has to offer, media companies need products and services that can be digitalised, personalised and automated. A connected CRM platform like Salesforce can consolidate sales, marketing, customer service and operations functions, creating workflow automations to save time, avoid human error in the process and deliver a single 360 degree view of the customer. Meanwhile, the same platform collects and analyses data to inform and recommend via AI smarter sales and marketing decisions that are likely to increase customer lifetime value and advertising revenue – a valuable asset to media companies.

Read more about how the team at Trigg Digital helped one of the world’s biggest media houses to improve sales, service and marketing efficiencies through CRM: https://www.triggdigital.com/case-studies/case-study-global-media-company/

An Ever-Changing Beast

The media industry has always been quick to evolve, and is changing faster than ever. No one can predict the future of the industry with complete certainty, but the media experts at Trigg have given it a good go. To keep up with changes in the media industry as they happen, follow us on LinkedIn, and subscribe to our monthly newsletter, TRIGGering Change, for a round-up of industry news, updates, and thought leadership pieces.

+44 203 239 8492

- Top 6 Media Trends for 2023 - November 3, 2022